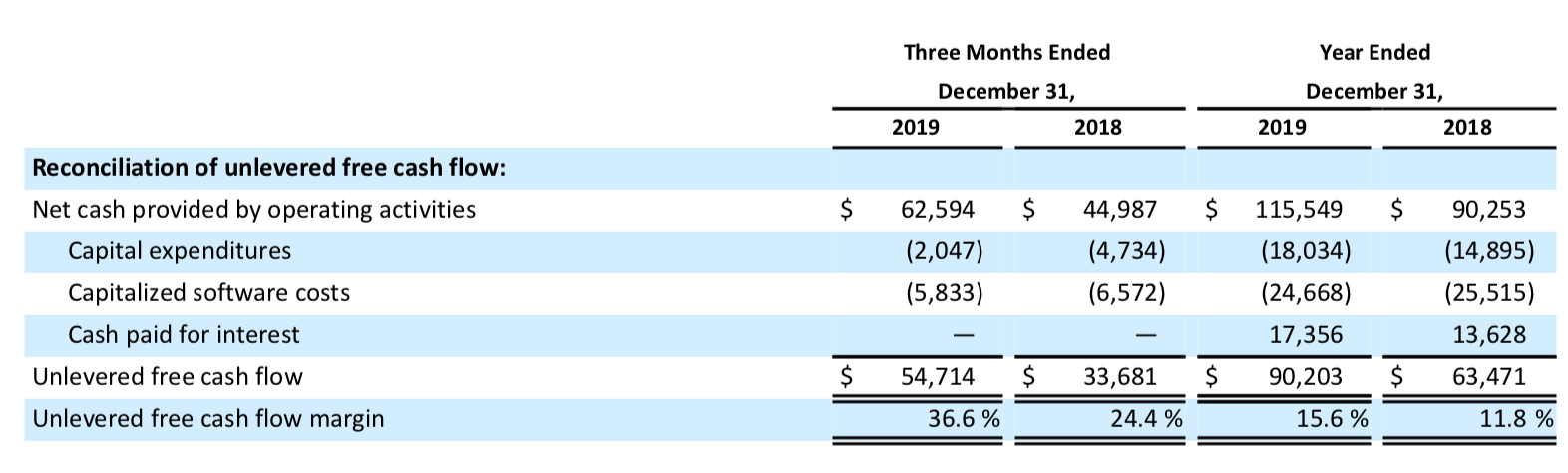

unlevered free cash flow margin

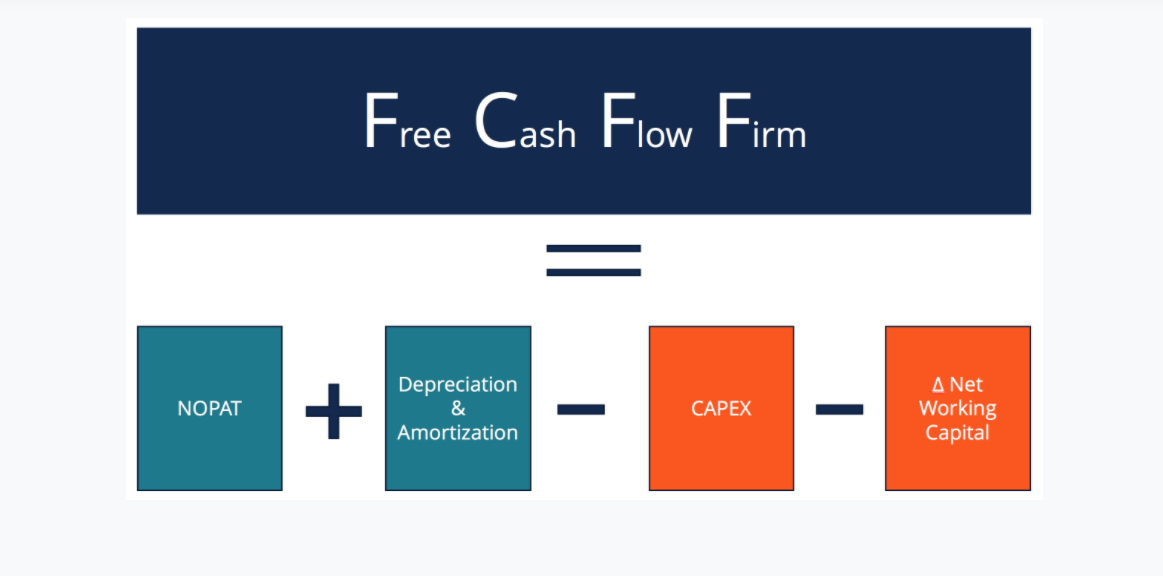

It is the cash flow available to all equity. Unlevered and levered cash flow will appear on your.

Free Cash Flow To Firm Fcff Formulas Definition Example Wall Street Oasis

Free cash flow is the amount of money left over when all outflow is subtracted.

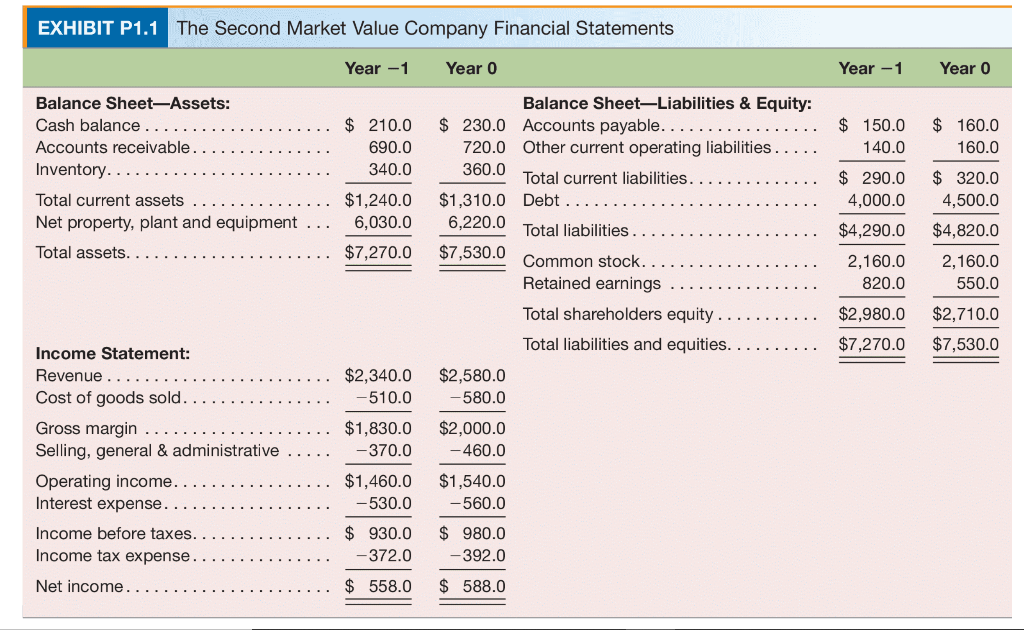

. We divide the taxes by the operating income which equals. Okay now lets determine what the levered cash flow for Intel is for year-end. Related to Unlevered Free Cash Flow Margin.

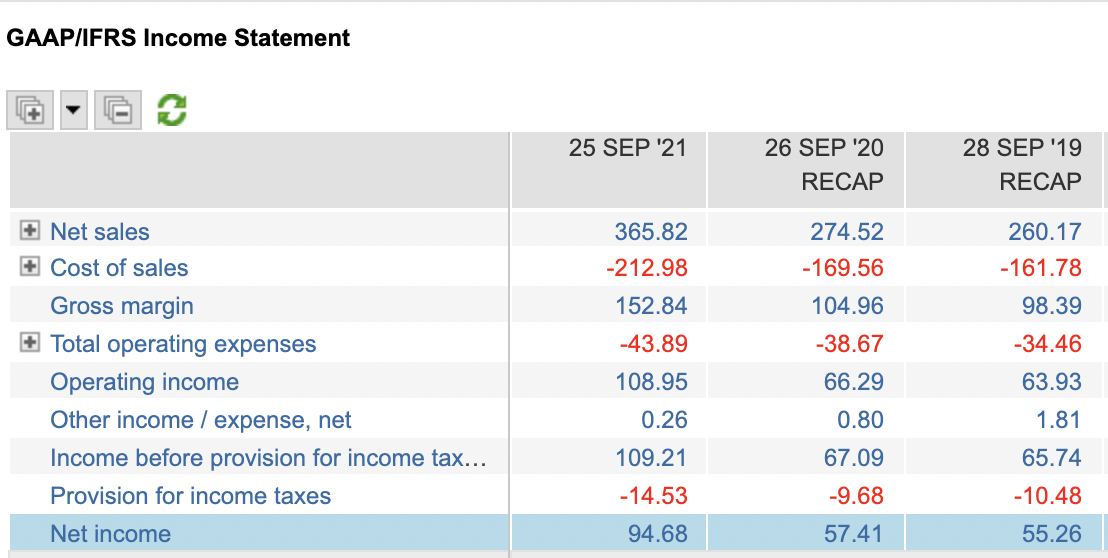

Unlevered Free Cash Flow Margin. Both free cash flow FCF and earnings before interest tax depreciation and amortization EBITDA are methods for examining the earnings a business generates. The generic Free Cash Flow FCF Formula is equal to Cash from Operations minus Capital Expenditures.

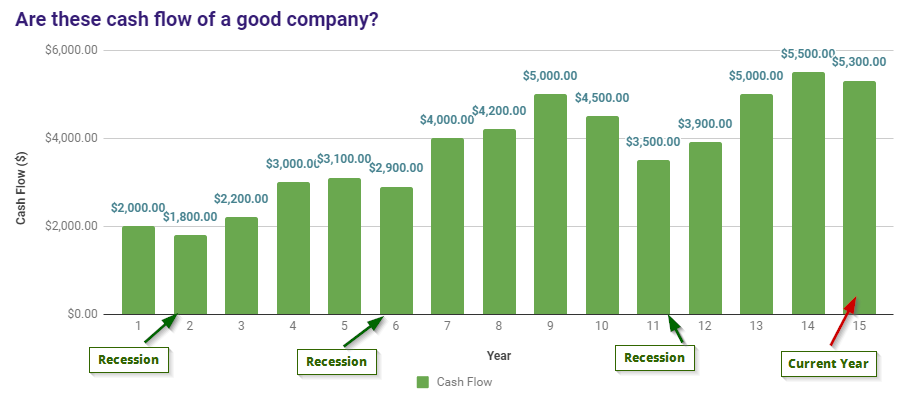

ONE Group Hospitalitys latest twelve months unlevered free cash flow margin is 88. Levered free cash flow is important to both investors and. Margin tells us what portion of sales ends up as.

Free Cash Flow means any available cash for distribution generated from the net income received by a Series as determined by the. Teslas latest twelve months unlevered free cash flow margin is 116. Teslas unlevered free cash flow margin for fiscal years ending December 2017 to 2021.

Tax rate 4179 23876 1705. FCF represents the amount of cash generated by a business after. Coca-Colas latest twelve months unlevered free cash flow margin is 234.

Levered free cash flow is the amount of cash that a company has remaining after accounting for payments to settle financial obligations short and long term including principal repayments. View Zeus Holdings Incs Unlevered Free Cash Flow Margin trends charts and more. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

Looking back at the last five years Costco Wholesales. The formula to calculate unlevered free cash flow margin and an example calculation for Colgate-Palmolives trailing twelve months is outlined below. Free cash flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures.

View The Coca-Cola Companys Unlevered Free Cash Flow Margin trends charts and more. Unlevered Free Cash Flow Margin. The formula to calculate unlevered free cash flow margin and an example calculation for Toyota Motors trailing twelve months is outlined below.

Free Cash Flow - FCF. Free Cash Flow Margin. Increases unlevered free cash flow High margin activities and products give a high level profit as compared to the amount of money that is spend hence increasing the unlevered free cash.

View The ONE Group Hospitality Incs Unlevered Free Cash Flow Margin trends charts and more. Free cash flow indicates gross cash flow rather than net. Get the tools used by smart 2 investors.

Costco Wholesales operated at median unlevered free cash flow margin of 20 from fiscal years ending September 2018 to 2022. Free Cash Flow margin is a ratio in which FCF is the numerator and sales is the denominator. Levered free cash flow is the amount of cash a company has left remaining after paying all its financial obligations.

A Quick Primer On The Rule Of 40 Scale Venture Partners

Net Profit Ebitda Operating Cashflow And Free Cashflow In Dividend Investing

How To Do Cash Flow Analysis The Right Way Ir

The Potential Impact Of Lease Accounting On Equity Valuation The Cpa Journal

Unlevered Free Cash Flow Definition Examples Formula

Solved Prepare An Unlevered Free Cash Flow Schedule For The Chegg Com

5 2 Valuation And Dcf Analysis How To Project Free Cash Flow Flashcards Quizlet

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

What Is Levered Free Cash Flow Lfcf Definition And Calculation

Cornerstone Ondemand It S Now About The Cash Flow Nasdaq Csod Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Understanding Levered Vs Unlevered Free Cash Flow

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

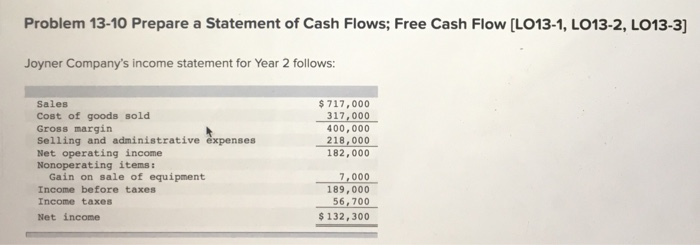

Solved Problem 13 10 Prepare A Statement Of Cash Flows Free Chegg Com

Free Cash Flow Formula Levered Vs Unlevered Free Cash Flow Study Com

Which S P 500 Sectors Have The Highest Margins Financial Market Commentary

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers